Cosmetic Dentistry Market by Product (Dental Implant, Dental Bridge & Crown, Orthodontic Braces, Denture, Dental Laser, Dental Handpiece, Bonding Agent, Dental Chair, CAD/CAM System, Radiology Equipment), End User & Region - Global Forecasts to 2025

Market Growth Outlook Summary

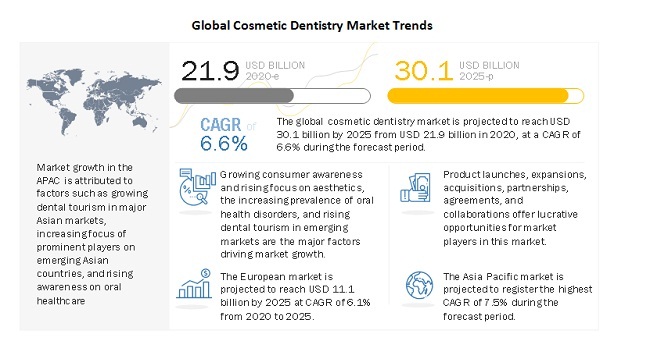

The global cosmetic dentistry market growth forecasted to transform from $21.9 billion in 2020 to $30.1 billion by 2025, driven by a CAGR of 6.6%. The global market is estimated to witness significant growth during the forecast period due to the growing consumer awareness and rising focus on aesthetics, increasing prevalence of oral health disorders, and rising dental tourism in emerging markets. Furthermore, development of technologically advanced solutions and increasing number of dental laboratories investing in CAD/CAM technologies will also propel the market growth during the forecast period. However, the high cost of dental imaging systems, lack of reimbursement for cosmetic procedures, and high risks and complications associated with dental bridges and orthodontic treatments are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Cosmetic Dentistry Market Dynamics

DRIVER: Growing consumer awareness and rising focus on aesthetics

The demand for cosmetic dentistry has recorded a steady rise over the past few years. While the demand for tooth-whitening procedures has grown significantly, veneers, non-metallic inlays and onlays, dental crowns, and bonding agents are among the most preferred cosmetic products. As per the American Academy of Cosmetic Dentistry (AACD), around USD 2.75 billion is spent every year on cosmetic dentistry alone in the US.

Governments and companies have also undertaken several initiatives in this area. As an example, the Indian Dental Association’s National Oral Health Program aimed to improve oral healthcare through the synergistic and equitable distribution of general and oral health facilities and coordination with the public and private sectors. Such activities help spread awareness, which plays a strong role in the demand for dental equipment and consumables. Other considerations include the growing emphasis on aesthetics and appearance. Smile restoration and improvements in appearance have gained significant importance.

The baby boomer population is emerging as a key consumer segment for cosmetic dentistry. As per the American Academy of Cosmetic Dentistry (AACD), adults between the age group of 31-40 years and baby boomers were most likely to inquire about cosmetic dentistry in the US. It also states that a major segment of cosmetic patients falls in the 40-49 age category, followed by the 50-plus segment (around 25%).

RESTRAINT: Risks and complications associated with dental bridges and orthodontic treatments

Dental bridge treatments and orthodontic treatments are widely used across the globe. However, their adoption is largely restricted by dental and periodontal complications associated with these treatments. These bridges can lead to the deterioration of the bone surrounding the previous teeth, thus weakening the bone structure.

Similarly, patients undergoing orthodontic treatments may face several risks and complications after or during the procedure, such as enamel damage during the bonding and de-bonding of orthodontic devices. Other issues related to orthodontic treatments include sensitivity, allergies, plaque, tartar, bad breath, tooth discoloration, and root resorption. These common problems associated with orthodontic treatments and dental bridges may hamper their adoption in the coming years.

Opportunity: Development of technologically advanced solutions

Cosmetic dentistry has evolved over the years with the development of new dental materials that enable superior results. Patient compliance has concurrently increased, with a sharp rise in the demand for minimally invasive procedures. Dental lasers have seen increasing use in surgical procedures such as gum lifting and teeth whitening to eliminate or minimize blood loss and reduce patient discomfort. Adhesive dentistry is another area that has gained attention—this uses composite materials to improve aesthetics and strengthen teeth with minimal damage to tooth structures. As a result, the number of people opting for such procedures is increasing. Thus, the focus on the development of new technologies and dental materials are expected to create new opportunities for players in the cosmetic dentistry market.

Challenge: High price of cosmetic dental procedures

Pricing pressure is one of the major challenges faced by players in the global cosmetic dentistry market. The major players in this market have been successful in establishing their position in the global market; however, entry into local markets has been a major challenge for these players. This is because products in local markets are generally priced lower as compared to international markets. Currently, global players are focusing on adopting different strategies to combat this challenge, maintain their position in the global market, and establish their presence in local markets characterized by low-priced products.

To know about the assumptions considered for the study, download the pdf brochure

Dental systems & equipment accounted for the largest share in the cosmetic dentistry industry in the forecast period.

By product, the cosmetic dentistry market is segmented into dental implants, bridges, crowns, veneers, braces, bonding agents, composites, inlays & onlays, and dental systems & equipment. In 2019, the dental systems & equipment segment accounted for the largest share of the global market, mainly due to the widespread use of instruments such as handpieces, dental chairs, and CAD/CAM technology in various cosmetic procedures. The orthodontic braces segment is expected to grow at the highest CAGR during the forecast period.

Dental hospitals and clinics expected to show the highest growth rate in the forecast period.

Based on the end user, the cosmetic dentistry market is segmented into dental hospitals & clinics, dental laboratories, and other end users (research institutes and cosmetic clinics). The growth of this market segment is primarily driven by the increasing number of dental clinics and hospitals, especially in emerging markets, and the rapid adoption of advanced technologies in these settings. Furthermore, the growing demand for cosmetic dentistry is expected to drive the demand for dental equipment and consumables in dental hospitals and clinics.

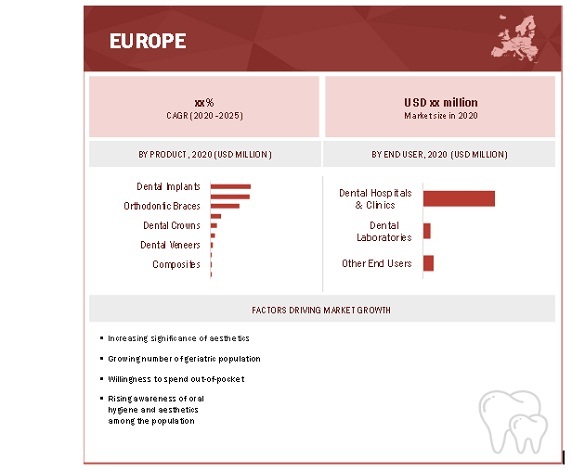

The Europe region holds the largest share in the cosmetic dentistry industry during the forecast period of 2020–2025.

Geographically, the cosmetic dentistry market is segmented into North America, Europe, the Asia Pacific and Rest of the World. The increasing significance of aesthetics, growth of the aging population, willingness to spend out-of-pocket, and rising awareness of oral hygiene and aesthetics are the primary drivers for the growth of the European markets.

The key players operating in the cosmetic dentistry market include Henry Schein (US), DENTSPLY Sirona (US), Envista Holdings (US), Align Technology (US), and Straumann Holdings (Switzerland).

Scope of the Cosmetic Dentistry Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$21.9 billion |

|

Projected Revenue Size by 2025 |

$30.1 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.6% |

|

Market Driver |

Growing consumer awareness and rising focus on aesthetics |

|

Market Opportunity |

Development of technologically advanced solutions |

The research report categorizes the cosmetic dentistry market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Dental Systems and Equipment

- Instrument Delivery Systems

- Dental Chairs

- Dental Handpieces

- Light Curing Equipment

- Dental Scaling Units

-

Dental CAD/CAM Systems

- In-office CAD/CAM Systems

- In-lab CAD/CAM Systems

- Dental Lasers

-

Dental Radiology Equipment

- Extraoral Radiology Equipment

- Intraoral Radiology Equipment

- Cone-Beam Computed Tomography (CBCT) Scanners

-

Dental Implants

- Titanium Implants

- Zirconium Implants

-

Dental Bridges

- Traditional Bridges

- Maryland Bridges

- Cantilever Bridges

- Dental Crowns

- Dental Veneers

-

Dentures

- Fixed Dentures

- Removable Dentures

-

Orthodontic Braces

- Fixed Braces

- Removable Braces

- Composites

- Bonding Agents

- Inlays and Onlays

By End User

- Dental Hospitals and Clinics

- Dental Laboratories

- Other

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Cosmetic Dentistry Industry

- In February 2020, Kavo Kerr (US) launched KaVo IXS Sensors. This product launch will broaden the company’s portfolio

- In September 2019, Henry Schein One (US) acquired Lighthouse 360 (Georgia) to expand Henry Schein One’s marketing and client communication solutions

- In July 2019, A-dec, Inc. (US) acquired Dean Dental Systems (US) to expand A-dec’s product offerings and develop innovate solutions for the dental industry

- In February 2019, 3Shape launched TRIOS 3 Basic intraoral scanner. This product launch will broaden the company’s portfolio

- In January 2019, DENTSLPY Sirona (US) collaborated with Carbon (US) to produce premium printable denture material systems offering substantial advancements in laboratory processes, material benefits, and patient function

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cosmetic dentistry market?

The global cosmetic dentistry market boasts a total revenue value of $30.1 billion by 2025.

What is the estimated growth rate (CAGR) of the global cosmetic dentistry market?

The global cosmetic dentistry market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $21.9 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 COSMETIC DENTISTRY MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION (APPROACH 1): SUPPLY-SIDE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL COSMETIC DENTISTRY INDUSTRY FOR DENTAL SYSTEMS & EQUIPMENT, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL COSMETIC DENTISTRY INDUSTRY, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL COSMETIC DENTISTRY INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 COSMETIC DENTISTRY MARKET OVERVIEW

FIGURE 12 GROWING AWARENESS AND RISING FOCUS ON AESTHETICS ARE DRIVING MARKET GROWTH

4.2 ASIA PACIFIC: COSMETIC DENTISTRY INDUSTRY, BY PRODUCT AND COUNTRY (2019)

FIGURE 13 DENTAL SYSTEMS & EQUIPMENT SEGMENT ACCOUNTS FOR THE LARGEST SHARE OF THE APAC MARKET

4.3 GLOBAL COSMETIC DENTISTRY INDUSTRY, BY REGION, 2020-2025

FIGURE 14 EUROPE WILL CONTINUE TO DOMINATE THE GLOBAL COSMETIC DENTISTRY INDUSTRY IN 2025

4.4 GLOBAL COSMETIC DENTISTRY INDUSTRY: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 15 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 COSMETIC DENTISTRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing consumer awareness and rising focus on aesthetics

5.2.1.2 Increasing prevalence of oral health disorders

5.2.1.2.1 Dental caries and other periodontal disorders

5.2.1.2.2 Edentulism

FIGURE 17 US: NUMBER OF PEOPLE SUFFERING FROM ABSENCE OF ALL-NATURAL TEETH (2018)

TABLE 1 INCREASE IN GERIATRIC POPULATION, 2019 VS 2050

5.2.1.3 Rising dental tourism in emerging markets

5.2.2 RESTRAINTS

5.2.2.1 High cost of dental imaging systems and lack of reimbursement for cosmetic procedures

5.2.2.2 Risks and complications associated with dental bridges and orthodontic treatments

5.2.3 OPPORTUNITIES

5.2.3.1 Development of technologically advanced solutions

5.2.3.2 Increasing number of dental laboratories investing in CAD/CAM technologies

5.2.4 CHALLENGES

5.2.4.1 High price of cosmetic dental procedures

6 INDUSTRY INSIGHTS (Page No. - 57)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 RISING NUMBER OF MINIMALLY INVASIVE COSMETIC DENTAL PROCEDURES

6.2.2 MARKET CONSOLIDATION

TABLE 2 MAJOR ACQUISITIONS IN THE COSMETIC DENTISTRY MARKET (2017-2019)

6.2.3 FOCUS ON PRODUCT DEVELOPMENT

6.3 REVENUE ANALYSIS OF THE TOP FIVE PLAYERS

FIGURE 18 GLOBAL COSMETIC DENTISTRY INDUSTRY: REVENUE ANALYSIS

6.4 VALUE CHAIN ANALYSIS

FIGURE 19 GLOBAL COSMETIC DENTISTRY INDUSTRY: VALUE CHAIN ANALYSIS

6.5 PRICING ANALYSIS OF DENTAL IMPLANTS

6.5.1 PREMIUM IMPLANTS

FIGURE 20 AVERAGE SELLING PRICE OF PREMIUM IMPLANTS, BY REGION, 2017 VS. 2023

6.5.2 VALUE IMPLANTS

FIGURE 21 AVERAGE SELLING PRICE OF VALUE IMPLANTS, BY REGION, 2017 VS. 2023

6.5.3 DISCOUNTED IMPLANTS

FIGURE 22 AVERAGE SELLING PRICE OF DISCOUNTED IMPLANTS, BY REGION, 2017 VS. 2023

TABLE 3 AVERAGE COST OF PROCEDURES AND SYSTEMS, BY TYPE

7 COSMETIC DENTISTRY MARKET, BY PRODUCT (Page No. - 64)

7.1 INTRODUCTION

7.2 IMPACT OF COVID-19 ON THE GLOBAL COSMETIC DENTISTRY INDUSTRY, BY PRODUCT

TABLE 4 GLOBAL COSMETIC DENTISTRY INDUSTRY, BY PRODUCT, 2018-2025 (USD MILLION)

7.3 DENTAL SYSTEMS & EQUIPMENT

TABLE 5 GLOBAL COSMETIC DENTISTRY INDUSTRY FOR DENTAL SYSTEMS & EQUIPMENT, BY TYPE, 2018-2025 (USD MILLION)

TABLE 6 GLOBAL COSMETIC DENTISTRY INDUSTRY FOR DENTAL SYSTEMS & EQUIPMENT, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1 DENTAL RADIOLOGY EQUIPMENT

TABLE 7 DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 8 DENTAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1.1 Extraoral radiology equipment

7.3.1.1.1 Increasing patient pool for dental procedures will benefit the segment growth

TABLE 9 EXTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1.2 Intraoral radiology equipment

7.3.1.2.1 Availability of technologically advanced intraoral scanners will contribute to market growth

TABLE 10 INTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.1.3 Cone-beam computed tomography scanners

7.3.1.3.1 CBCT systems are highly affordable as compared to their counterparts

TABLE 11 CBCT SCANNERS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2 CAD/CAM SYSTEMS

TABLE 12 CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 13 CAD/CAM SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2.1 In-lab systems

7.3.2.1.1 Increasing demand for single-tooth implants, veneers, and crowns will benefit the segment growth

TABLE 14 IN-LAB CAD/CAM SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2.2 In-office systems

7.3.2.2.1 Potential for cost-reduction will boost the adoption of in-office systems

TABLE 15 IN-OFFICE CAD/CAM SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.3 INSTRUMENT DELIVERY SYSTEMS

7.3.3.1 Ease of handling instruments and switches supports the demand for instrument delivery systems

TABLE 16 INSTRUMENT DELIVERY SYSTEMS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.4 DENTAL CHAIRS

TABLE 17 DENTAL CHAIRS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.5 HANDPIECES

7.3.5.1 Demand for hi-tech handpieces with higher efficiency and precision is expected to increase during the forecast period

TABLE 18 HANDPIECES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.6 LIGHT-CURING EQUIPMENT

7.3.6.1 Increasing number of in-office teeth whitening procedures has favored market growth

TABLE 19 LIGHT-CURING EQUIPMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.7 DENTAL LASERS

7.3.7.1 Dental lasers can eliminate tedious parts of dental treatment and greatly expedite procedural times

TABLE 20 DENTAL LASERS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.8 DENTAL SCALING DEVICES

7.3.8.1 Innovations in scaling devices will ensure growth in end-user demand

TABLE 21 DENTAL SCALING DEVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4 DENTAL IMPLANTS

FIGURE 23 MARKET SHARE ANALYSIS: DENTAL IMPLANT MARKET (2019)

TABLE 22 GLOBAL COSMETIC DENTISTRY INDUSTRY FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 23 GLOBAL COSMETIC DENTISTRY INDUSTRY FOR DENTAL IMPLANTS, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.1 TITANIUM IMPLANTS

7.4.1.1 Increase in consumer acceptance of advanced dental technologies will drive the use of titanium implants

TABLE 24 TITANIUM IMPLANTS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.2 ZIRCONIUM IMPLANTS

7.4.2.1 Advantages of zirconium in implants will support its use

TABLE 25 ZIRCONIUM IMPLANTS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.5 ORTHODONTIC BRACES

TABLE 26 GLOBAL MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 27 GLOBAL MARKET FOR ORTHODONTIC BRACES, BY COUNTRY, 2018-2025 (USD MILLION)

7.5.1 FIXED BRACES

7.5.1.1 Fixed braces are priced lower than removable braces, which greatly increases patient access

TABLE 28 FIXED BRACES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.5.2 REMOVABLE BRACES

7.5.2.1 Increasing demand for invisible braces due to aesthetic concerns will augment market growth in the coming years

TABLE 29 REMOVABLE BRACES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6 DENTAL BRIDGES

TABLE 30 GLOBAL MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 31 GLOBAL MARKET FOR DENTAL BRIDGES, BY COUNTRY, 2018-2025 (USD MILLION)

7.6.1 TRADITIONAL BRIDGES

7.6.1.1 The longevity of traditional bridges drives end-user adoption

TABLE 32 TRADITIONAL BRIDGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6.2 MARYLAND BRIDGES

7.6.2.1 Rapid installation times of Maryland bridges has supported their use

TABLE 33 MARYLAND BRIDGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6.3 CANTILEVER BRIDGES

7.6.3.1 While aesthetically appealing, cantilever bridges are lacking in durability

TABLE 34 CANTILEVER BRIDGES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.7 DENTAL CROWNS

7.7.1 INCREASING INCIDENCE OF TOOTH CARIES WILL AUGMENT THE DEMAND FOR DENTAL CROWNS OVER THE FORECAST PERIOD

TABLE 35 GLOBAL MARKET FOR DENTAL CROWNS, BY COUNTRY, 2018-2025 (USD MILLION)

7.8 DENTURES

TABLE 36 GLOBAL MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 37 GLOBAL MARKET FOR DENTURES, BY COUNTRY, 2018-2025 (USD MILLION)

7.8.1 REMOVABLE DENTURES

7.8.1.1 Tedious and lengthy procedure might hamper the segment growth during the forecast period

TABLE 38 REMOVABLE DENTURES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.8.2 FIXED DENTURES

7.8.2.1 Increasing prevalence of oral health disorders will stimulate segment growth

TABLE 39 FIXED DENTURES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.9 DENTAL VENEERS

7.9.1 VENEERS ARE MAINLY USED TO IMPROVE COLOR, SHAPE, SIZE, OR UNEVENNESS IN TEETH

TABLE 40 GLOBAL MARKET FOR DENTAL VENEERS, BY COUNTRY, 2018-2025 (USD MILLION)

7.1 BONDING AGENTS

7.10.1 INCREASING EMPHASIS ON BONDING AGENTS AS AN ALTERNATIVE TO CROWNS & IMPLANTS WILL SUPPORT MARKET GROWTH

TABLE 41 GLOBAL MARKET FOR BONDING AGENTS, BY COUNTRY, 2018-2025 (USD MILLION)

7.11 COMPOSITES

7.11.1 COMPOSITES ARE SPECIALLY DESIGNED FOR ANTERIOR RESTORATION AS THEY RESEMBLE THE STRUCTURE OF A NATURAL TOOTH

TABLE 42 GLOBAL MARKET FOR COMPOSITES, BY COUNTRY, 2018-2025 (USD MILLION)

7.12 INLAYS & ONLAYS

7.12.1 GROWING AWARENESS ON ORAL HYGIENE IS EXPECTED TO DRIVE MARKET GROWTH

TABLE 43 GLOBAL MARKET FOR INLAYS & ONLAYS, BY COUNTRY, 2018-2025 (USD MILLION)

8 COSMETIC DENTISTRY MARKET, BY END USER (Page No. - 101)

8.1 INTRODUCTION

8.2 IMPACT OF COVID-19 ON THE GLOBAL COSMETIC DENTISTRY INDUSTRY, BY END USER

TABLE 44 GLOBAL MARKET, BY END USER, 2018-2025 (USD MILLION)

8.3 DENTAL HOSPITALS & CLINICS

8.3.1 INCREASING NUMBER OF HOSPITALS & CLINICS IN EMERGING MARKETS WILL DRIVE MARKET GROWTH

TABLE 45 GLOBAL MARKET FOR DENTAL HOSPITALS & CLINICS, BY COUNTRY, 2018-2025 (USD MILLION)

8.4 DENTAL LABORATORIES

8.4.1 INCREASING PATIENT PREFERENCE FOR COSMETIC DENTISTRY WILL DRIVE DEMAND FOR LAB-MADE PRODUCTS

TABLE 46 GLOBAL MARKET FOR DENTAL LABORATORIES, BY COUNTRY, 2018-2025 (USD MILLION)

8.5 OTHER END USERS

TABLE 47 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2018-2025 (USD MILLION)

9 COSMETIC DENTISTRY MARKET, BY REGION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 24 CHINA IS EXPECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 48 GLOBAL COSMETIC DENTISTRY INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

9.2 EUROPE

FIGURE 25 EUROPE: COSMETIC DENTISTRY MARKET SNAPSHOT

TABLE 49 EUROPE: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 EUROPE: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 55 EUROPE: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 56 EUROPE: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 EUROPE: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.1 GERMANY

9.2.1.1 Germany holds the largest share of the European market

TABLE 59 GERMANY: DENTAL INDUSTRY OVERVIEW, 2011-2018

TABLE 60 GERMANY: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 61 GERMANY: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 62 GERMANY: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 GERMANY: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 64 GERMANY: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 65 GERMANY: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 66 GERMANY: COSMETIC DENTISTRY INDUSTRY FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 67 GERMANY: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 68 GERMANY: DENTISTRY MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.2 FRANCE

9.2.2.1 Rising awareness regarding dental diseases is expected to boost the market growth in France

TABLE 69 FRANCE: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 70 FRANCE: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 71 FRANCE: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 72 FRANCE: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 73 FRANCE: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 74 FRANCE: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 75 FRANCE: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 76 FRANCE: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.3 UK

9.2.3.1 Growing incidence of dental disorders and an increase in the geriatric population are expected to drive the market growth in the UK

TABLE 78 UK: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 79 UK: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 80 UK: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 81 UK: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 82 UK: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 83 UK: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 84 UK: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 85 UK: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 86 UK: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.2.4 ITALY

9.2.4.1 Rising number of international players to boost market growth

TABLE 87 ITALY: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 88 ITALY: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 ITALY: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 90 ITALY: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 91 ITALY: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 92 ITALY: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 93 ITALY: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 94 ITALY: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 95 ITALY: MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.5 SPAIN

9.2.5.1 Short study start-up times and rising R&D expenditure to boost the growth of the Spanish market

TABLE 96 SPAIN: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION) 127

TABLE 97 SPAIN: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 98 SPAIN: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION) 128

TABLE 99 SPAIN: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 100 SPAIN: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 101 SPAIN: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 102 SPAIN: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 103 SPAIN: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION) 129

TABLE 104 SPAIN: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.2.6 REST OF EUROPE

TABLE 105 ROE: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION) 130

TABLE 106 ROE: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 107 ROE: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION) 131

TABLE 108 ROE: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 109 ROE: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 ROE: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 111 ROE: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 112 ROE: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 113 ROE: MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3 NORTH AMERICA

TABLE 114 NORTH AMERICA: COSMETIC DENTISTRY MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 117 NORTH AMERICA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 118 NORTH AMERICA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 123 NORTH AMERICA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.3.1 US

9.3.1.1 US dominates the North American market for cosmetic dentistry

TABLE 124 US: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION) 137

TABLE 125 US: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 126 US: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 127 US: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 128 US: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 129 US: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 130 US: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 131 US: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 132 US: MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Rising geriatric population will drive market growth

TABLE 133 CANADA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 134 CANADA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 135 CANADA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 136 CANADA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 137 CANADA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 138 CANADA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 139 CANADA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 140 CANADA: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 141 CANADA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: COSMETIC DENTISTRY MARKET SNAPSHOT

TABLE 142 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 145 ASIA PACIFIC: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY END USER, 2020-2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Rising geriatric population will play a strong role in driving market growth in Japan

TABLE 152 JAPAN: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020-2025 (USD MILLION)

TABLE 153 JAPAN: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 154 JAPAN: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 155 JAPAN: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 156 JAPAN: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 157 JAPAN: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 158 JAPAN: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 159 JAPAN: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 160 JAPAN: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2020-2025 (USD MILLION)

9.4.2 SOUTH KOREA

9.4.2.1 The market in South Korea is driven by growing medical tourism and the availability of a wide range of products

TABLE 161 SOUTH KOREA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020-2025 (USD MILLION) 152

TABLE 162 SOUTH KOREA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 163 SOUTH KOREA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 164 SOUTH KOREA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 165 SOUTH KOREA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 166 SOUTH KOREA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 167 SOUTH KOREA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 168 SOUTH KOREA: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 169 SOUTH KOREA: MARKET, BY END USER, 2020-2025 (USD MILLION)

9.4.3 CHINA

9.4.3.1 Growth of the private dental care sector drives the market in China

TABLE 170 CHINA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020-2025 (USD MILLION)

TABLE 171 CHINA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 172 CHINA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 173 CHINA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 174 CHINA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 175 CHINA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 176 CHINA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 177 CHINA: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 178 CHINA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2020-2025 (USD MILLION)

9.4.4 INDIA

9.4.4.1 Growth of the dental care sector and rising foreign investment in India will drive the cosmetic dentistry market

TABLE 179 INDIA: MARKET, BY PRODUCT, 2020-2025 (USD MILLION)

TABLE 180 INDIA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 181 INDIA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 182 INDIA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 183 INDIA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 184 INDIA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 185 INDIA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 186 INDIA: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 187 INDIA: MARKET, BY END USER, 2020-2025 (USD MILLION)

9.4.5 AUSTRALIA

9.4.5.1 Increasing number of practicing dentists in Australia will contribute to market growth

TABLE 188 AUSTRALIA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020-2025 (USD MILLION)

TABLE 189 AUSTRALIA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 190 AUSTRALIA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 191 AUSTRALIA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 192 AUSTRALIA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 193 AUSTRALIA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 194 AUSTRALIA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 195 AUSTRALIA: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 196 AUSTRALIA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2020-2025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 197 ROAPAC: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2020-2025 (USD MILLION)

TABLE 198 ROAPAC: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 199 ROAPAC: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 200 ROAPAC: CAD/CAM SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 201 ROAPAC: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 202 ROAPAC: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 203 ROAPAC: MARKET FOR DENTAL BRIDGES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 204 ROAPAC: MARKET FOR DENTURES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 205 ROAPAC: MARKET, BY END USER, 2020-2025 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 GROWING DENTAL TOURISM TO DRIVE MARKET GROWTH IN LATIN AMERICA

TABLE 206 LATIN AMERICA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 208 LATIN AMERICA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 209 LATIN AMERICA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 214 LATIN AMERICA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 RISE IN AWARENESS ON ORAL HYGIENE INDICATES FAVORABLE PROSPECTS FOR THE MARKET IN THE MEA

TABLE 215 MIDDLE EAST & AFRICA: COSMETIC DENTISTRY MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET FOR DENTAL SYSTEMS & EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: DENTAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: CAD/CAM SYSTEMS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: MARKET FOR DENTAL IMPLANTS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: MARKET FOR ORTHODONTIC BRACES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET FOR DENTAL BRIDGES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 222 MIDDLE EAST & AFRICA: MARKET FOR DENTURES, BY TYPE, 2018-2025 (USD MILLION)

TABLE 223 MIDDLE EAST & AFRICA: COSMETIC DENTISTRY INDUSTRY, BY END USER, 2018-2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 175)

10.1 INTRODUCTION

FIGURE 27 KEY DEVELOPMENTS IN THE COSMETIC DENTISTRY MARKET

10.2 PRODUCT PORTFOLIO MATRIX

FIGURE 28 GLOBAL MARKET, BY PRODUCT: PRODUCT MATRIX

10.3 GLOBAL MARKET: GEOGRAPHICAL ASSESSMENT

FIGURE 29 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE GLOBAL MARKET (2019)

FIGURE 30 R&D EXPENDITURE OF KEY PLAYERS IN THE GLOBAL COSMETIC DENTISTRY INDUSTRY

10.4 COMPETITIVE SITUATION & TRENDS

10.4.1 PRODUCT LAUNCHES

10.4.2 EXPANSIONS

10.4.3 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

10.4.4 ACQUISITIONS

10.4.5 OTHER DEVELOPMENTS

11 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 181)

11.1 COSMETIC DENTISTRY MARKET SHARE ANALYSIS

FIGURE 31 MARKET SHARE ANALYSIS: GLOBAL MARKET (2019)

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE COMPANIES

11.2.4 EMERGING COMPANIES

FIGURE 32 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

11.3 COMPETITIVE LEADERSHIP MAPPING (SMALL & MEDIUM-SIZED COMPANIES/START-UPS)

11.3.1 PROGRESSIVE COMPANIES

11.3.2 STARTING BLOCKS

11.3.3 RESPONSIVE COMPANIES

11.3.4 DYNAMIC COMPANIES

FIGURE 33 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (EMERGING PLAYERS, 2019)

11.4 COMPANY PROFILES

(Business overview, Products offered, Recent developments, MNM view)*

11.4.1 HENRY SCHEI

FIGURE 34 HENRY SCHEIN: COMPANY SNAPSHOT (2019)

11.4.2 DENTSPLY SIRONA

FIGURE 35 DENTSPLY SIRONA: COMPANY SNAPSHOT (2019)

11.4.3 ENVISTA HOLDINGS CORPORATION

FIGURE 36 ENVISTA: COMPANY SNAPSHOT (2019)

11.4.4 ALIGN TECHNOLOGY

FIGURE 37 ALIGN TECHNOLOGY: COMPANY SNAPSHOT (2019)

11.4.5 STRAUMANN HOLDINGS

FIGURE 38 STRAUMANN HOLDINGS AG: COMPANY SNAPSHOT (2019)

11.4.6 3M COMPANY

FIGURE 39 3M COMPANY: COMPANY SNAPSHOT (2019)

11.4.7 KURARAY

FIGURE 40 KURARAY: COMPANY SNAPSHOT (2018)

11.4.8 PLANMECA GROUP

11.4.9 ZIMMER BIOMET HOLDINGS

FIGURE 41 ZIMMER BIOMET HOLDINGS: COMPANY SNAPSHOT (2019)

11.4.10 ROLAND DG CORPORATION

FIGURE 42 ROLAND DG CORPORATION: COMPANY SNAPSHOT (2019)

11.4.11 BIOLASE

FIGURE 43 BIOLASE: COMPANY SNAPSHOT (2019)

11.4.12 MIDMARK CORPORATION

11.4.13 A-DEC

11.4.14 3SHAPE

11.4.15 IVOCLAR VIVADENT

11.4.16 GC CORPORATION

11.4.17 RUNYES MEDICAL INSTRUMENT

11.4.18 J. MORITA CORP.

11.4.19 PREXION

11.4.20 YOSHIDA DENTAL

11.4.21 MILLENNIUM DENTAL TECHNOLOGIES

11.4.22 CARESTREAM DENTAL

11.4.23 TAKARA BELMONT

11.4.24 BRASSELER USA

11.4.25 DENTALEZ

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 247)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAIL

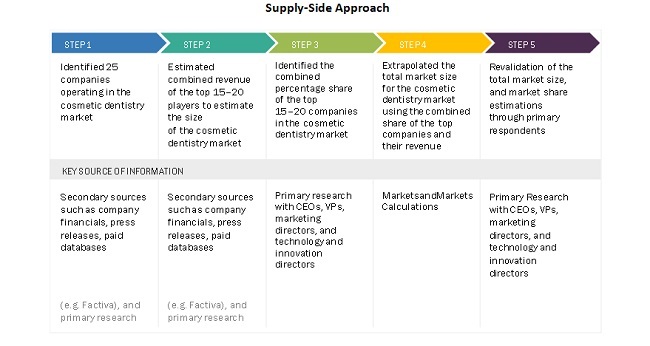

This study involved four major activities in estimating the current market size for cosmetic dentistry. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the number of breast lesion localization procedures and the value market. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the usage of widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

Primary Research

The cosmetic dentistry market comprises several stakeholders such as raw material suppliers, manufacturers of cosmetic dentistry devices, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include professionals such as dentists, technicians and professors. The primary sources from the supply side include key opinion leaders, distributors, and cosmetic dentistry device and consumables manufacturers.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the cosmetic dentistry market (in terms of value and volume). These approaches were also used extensively to estimate the size of various subsegments in the market. After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the cosmetic dentistry industry.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Supply-Side Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Approach to calculate the revenue of different players in the cosmetic dentistry market

The size of the global cosmetic dentistry market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global cosmetic dentistry market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Objectives of the Study

- To define, describe, analyze, and forecast the cosmetic dentistry market by product, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall cosmetic dentistry market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the cosmetic dentistry market

- To track and analyze competitive developments such as partnerships, collaborations, agreements, acquisitions, product launches, and expansions in the cosmetic dentistry market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe cosmetic dentistry market

- Further breakdown of the Rest of Asia Pacific cosmetic dentistry market

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cosmetic Dentistry Market